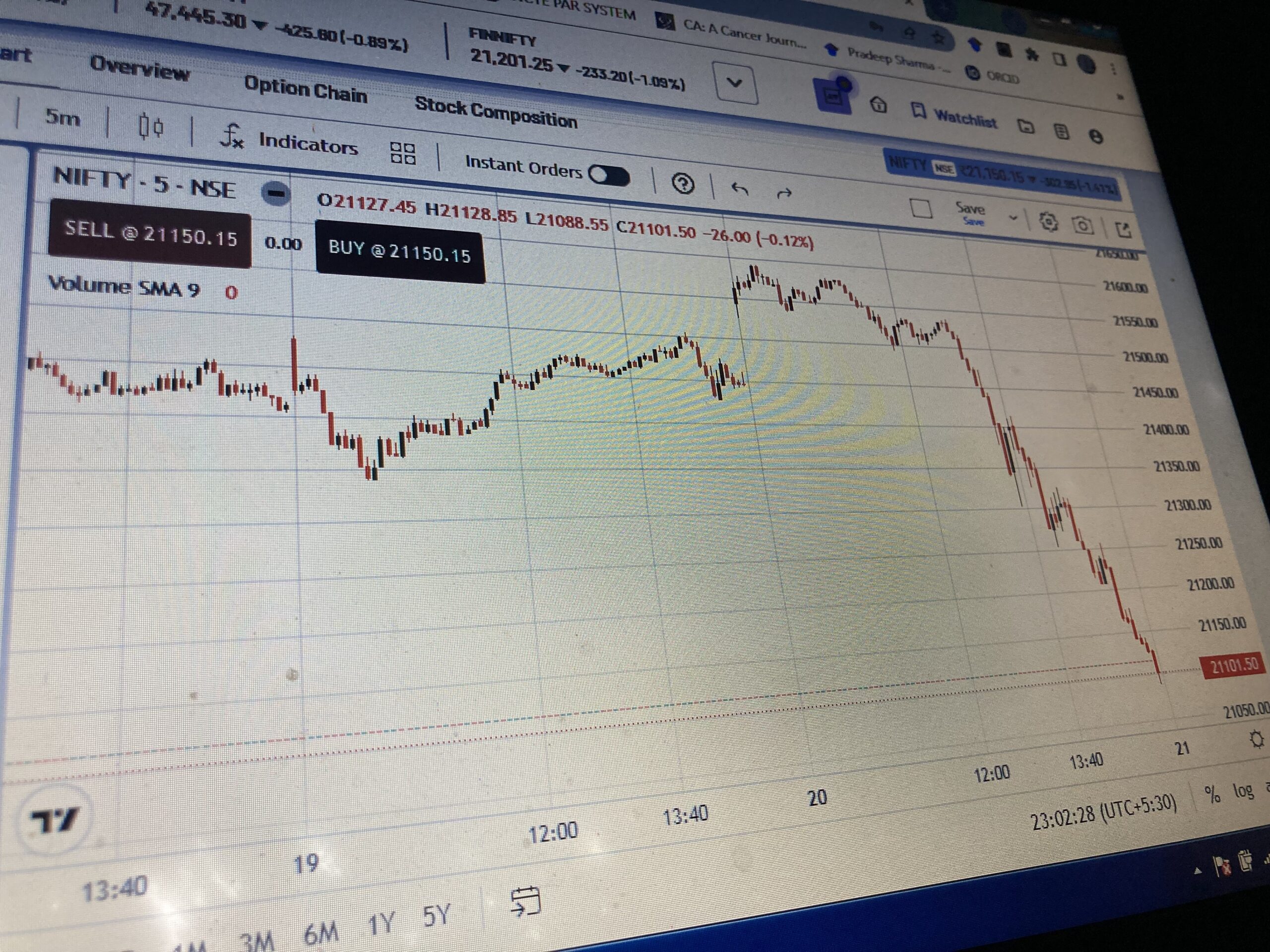

In a surprising turn of events, the stock market rally that propelled Sensex and Nifty to unprecedented heights over seven consecutive weeks came to an abrupt halt on Wednesday. The sudden plunge resulted in a staggering Rs 9 lakh crore loss in market capitalization, leaving market participants bewildered as no major red flags were apparent in global or domestic cues.

On one of the most challenging days for the market in 2023, Nifty recorded a 1.4% decline, and Sensex ended 931 points lower. The Nifty Midcap100 experienced its most substantial single-session decline in nearly a year, while the PSU bank index plummeted by 4%, marking its most significant single-session decline in over a year.

Despite FIIs being net sellers with a loss of Rs 1,322 crore, DIIs offset the deficit by recording a net buying of Rs 4,754 crore.

Several factors could be contributing to the unexpected fall in Sensex and Nifty:

- Profit Booking: Riding the wave of consistent FII inflows, Nifty witnessed a seven-week rally, culminating in a 5.5% upside in November the highest monthly gain since July 2022. Given the sharp rise in a short period, profit booking and a consolidative move were expected.

- Rising Covid-19 Cases: While Covid-19 has not become a major public health issue again, the recent increase in cases of the JN.1 sub-variant in India has raised concerns among some investors. Kerala reported 292 new active cases and 3 deaths, prompting Union Health Minister Mansukh Mandaviya to stress vigilance against emerging strains.

- Red Sea Tensions: Global trade disruption and geopolitical tensions in the Middle East, particularly in the Red Sea following attacks on ships by Yemen’s Iran-aligned Houthi forces, are being closely monitored by investors.

- Smallcap Bubble: The growing sentiment of a bubble in mid- and small-cap stocks, echoing Kotak Equities’ earlier concerns, suggests a need for correction. Some analysts argue that pockets of mid- and small-caps lack safety margins after a significant run-up, emphasizing the importance of market health through the reduction of froth.

- IPO Rush: December’s IPO-heavy environment, with 11 mainboard and several SME IPOs, might have contributed to the correction. Analysts propose that tight liquidity among High Net Worth Individuals (HNIs) involved in IPOs could have added to selling pressure.

- AIF Factor: The Reserve Bank of India’s (RBI) recent tightening of norms for banks and NBFCs utilizing the alternative investment fund (AIF) route to ‘evergreen’ their loans could have played a role. The directive requires regulated entities to liquidate their investments in AIF schemes within 30 days if downstream investments occur in debtor companies.