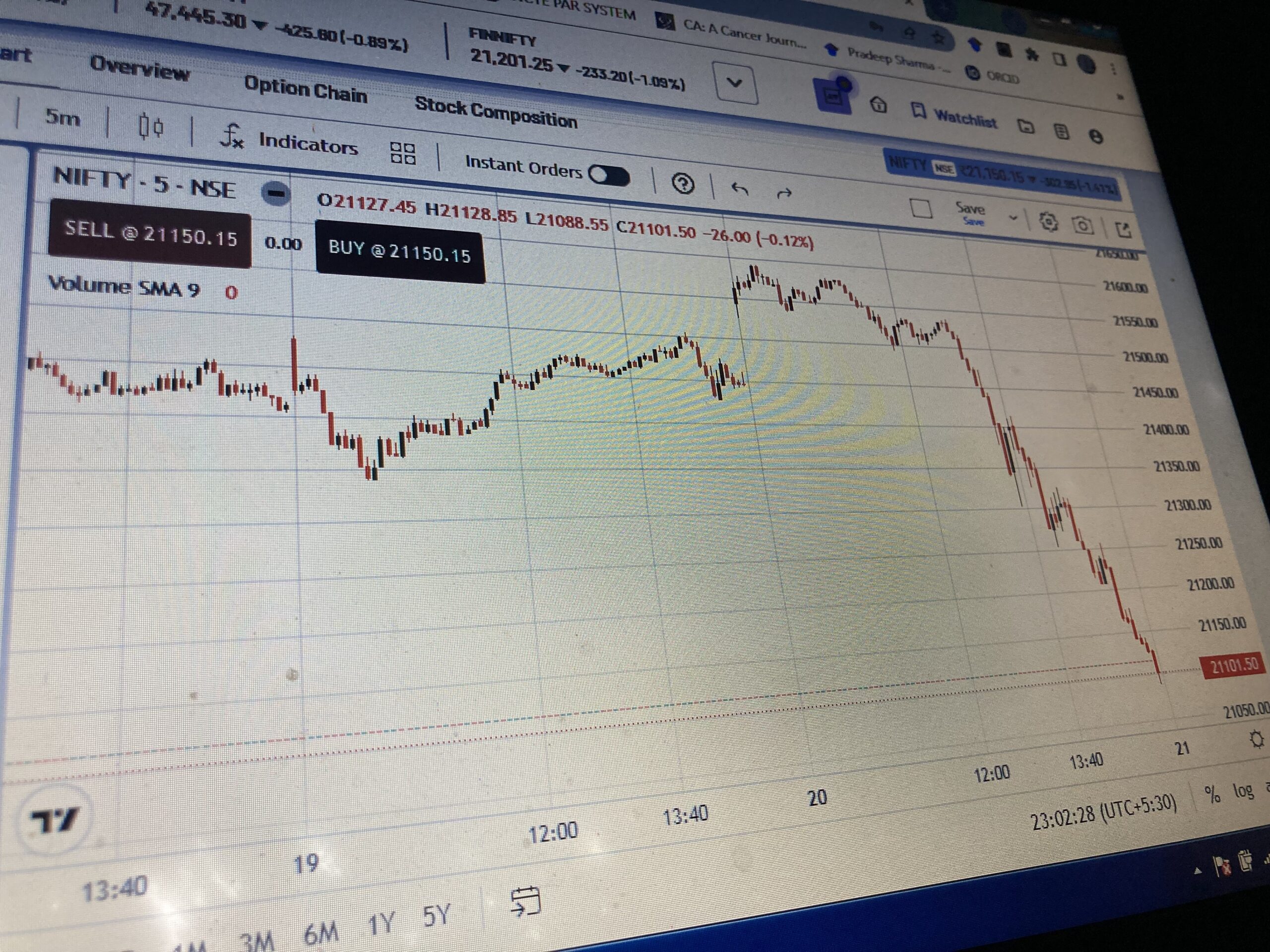

Stock market today: Ahead of US non farm payroll data and jobless claim data release, Indian stock market extended its weakness for second straight session on Friday. On Friday morning deals, 30-stock index Sensex opened with downside gap and hit intraday low of 58,884, around 920 points lower from its Thursday close of 59,806 levels. On Thursday too, Sensex had shed around 550 points that means the 30-stock index has shed to the tune of 1,450 pints in two straight sessions.

Global market triggers for Dalal Street : US dollar has eased after Dollar Index regained 105 levels on Wednesday. However, it failed to sustain on higher levels. But, the profit booking in US dollar has not come to the equities as investors are awaiting US non farm payroll data and US jobless claim data that is expected today. Experts also maintained that today’s sell off is because of the trickle down of weakness in banking stocks on Wall Street to Dalal Street.

Nifty Bank index today crashed over 850 points and most of the banking majors are trading red in early morning deals. Experts said that Sensex has strong support at 58,500 and there can be more downside movement if this 200 DMA support is broken.

“India’s markets have taken a significant hit as a result of weak global cues. The US market was under pressure due to the decline in shares of SVB bank and cryptocurrency financier Silver Capital, particularly in stocks related to banking and finance. We lack direction and are currently under selling pressure at higher levels as a result of the extremely volatile global cues over a long period of time. The most recent issue is more US-specific, and there is only an sentimental influence on markets worldwide.”

Reference: Asit Manohar| Mint