Indian equity market snapped a four-day losing streak and ended in positive territory with the Nifty closing above 18,000, amid buying in most sectors, except pharma.

At close, the Sensex was up 721.13 points or 1.20 percent at 60,566.42, while the Nifty was up 207.80 points or 1.17 percent at 18,014.60. Nearly 2,787 shares advanced, 733 shares declined, and 129 scrips remained unchanged.

After a flat start, the market gained momentum with Nifty inching closer to the 18,100 level intraday, erasing most of the previous session losses.

“After a four-day selloff, the domestic market was refuelled by bottom fishing and optimistic sentiment from global counterparts,” said Vinod Nair, Head of Research at Geojit Financial.

“PSBs led the rally, while mid- and small-cap stocks outpaced the benchmark.”

Stocks and sectors

SBI, IndusInd Bank, Hindalco Industries, Tata Steel and Coal India were among the biggest Nifty gainers. On the contrary, Divi’s Labs, Cipla, Dr Reddy’s Laboratories, Nestle India and Tata Consumer Products emerged as major losers.

Except pharma, (down 0.8 percent), all other sectoral indices ended in the green with the Nifty PSU bank index adding 7.3 percent. The Nifty Bank, Energy and Metal indices were up 2 percent each.

The BSE midcap index added 2.3 percent and smallcap index rose 3 percent.

On the BSE, power, realty, bank and metal indices rose 2-3 percent each, while auto, capital goods, FMCG, information technology and oil & gas indices were up 1.1.8 percent. However, the healthcare index fell 0.45 percent.

Among individual stocks, a volume spike of more than 200 percent was seen in Intellect Design Arena, Muthoot Finance and Sun TV Network.

A long build-up was seen in Punjab National Bank, Samvardhana Motherson International, Delta Corp, while a short build-up was seen in Dr Lal PathLabs, Lupin and Cipla.

More than 200 stocks touched their 52-week low on the BSE, including GTPL Hathway, Quess Corp, KPR Mills, Aurobindo Pharma, DCM Shriram, Bharat Rasayan, Infobeans Technologies, Natco Pharma, Sintex Industries, Voltas and TRIDENT.

Outlook for December 27

Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services:

Indian equites witnessed a strong recovery after the sharp sell-off last week. Nifty opened positive and gained strength throughout the session to close with gains of 208 points (+1.2%) at 18015 levels.

Action was seen in broader market post its 3 consecutive weeks of decline. Both Nifty Midcap 100 and Smallcap 100 outperformed Nifty with gains of 2.7%/3.8% respectively.

Except Pharma, all sectors ended in green. After sharp fall of 3% in Nifty over the last three trading sessions, value based buying emerged at lower levels.

In the absence of any major global events due to year-end holidays, we expect market to remain sideways to positive based on news flows. We expect focus on banks, auto, capital goods and defense sectors to do well in the near term.

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

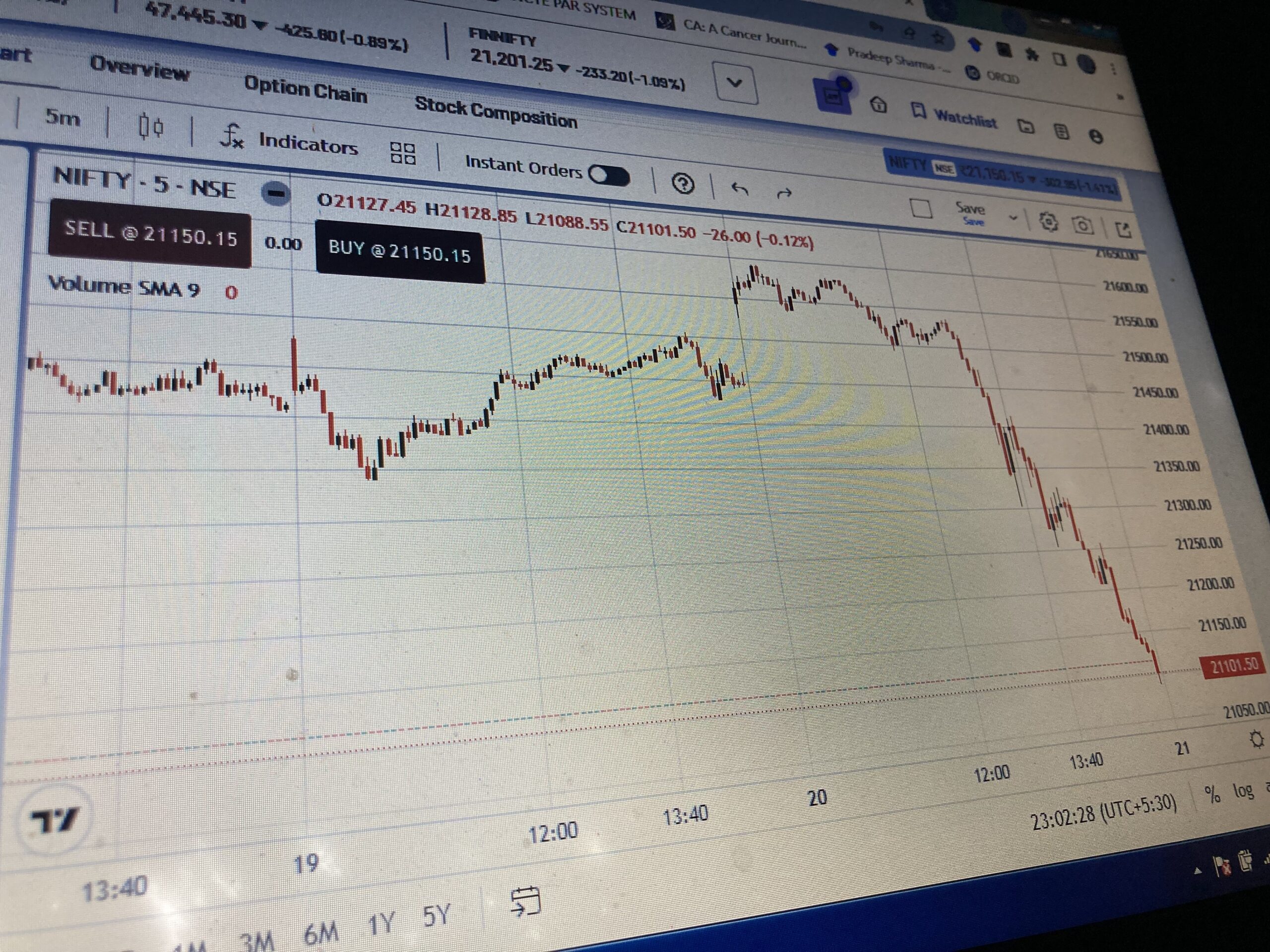

The Nifty had seen a sharp decline in the last week that had pushed the intraday momentum indicators into the oversold zone. In terms of the Fibonacci retracement, the index had reached 50% retracement of the rally from Sept 2022 to Dec 2022. Consequently, the index had a swift bounce on December 26.

It has moved up to retest a trendline, which was broken on the downside on Friday. Thus 18,100-18,200 will be the near term hurdle zone, which will decide further course of action for the index.

Overall structure shows that the Nifty is likely to witness short term consolidation with key support at 17,800.

Reference: Rakesh Patil | Money Control